Multifamily

Despite recent price declines, the single-family housing market remains expensive. As a result, a significant portion of new households will continue to become renters rather than owners, creating a backstop for apartment demand. Investors have maintained interest in the market, and 22Q3 saw the highest quarterly sales volume of the past 10 years. Transaction pricing in San Jose continues to be at one of the highest levels in the nation.

Vacancy

For the past 12 months, net absorption currently stands at 1,600 units, compared to the long-term average of 3,100 units. Together with an uptick in new deliveries in recent months, vacancy has increased to 5.5%, bringing the current performance in alignment with the metro’s longer-term average. And so in terms of vacancy, San Jose is once again outperforming the national average, which currently stands at 6.7%.

Construction

There are currently about 8,200 units under construction, representing 5.2% of the market’s inventory. This is equal to the all-time high level of construction activity. Submarkets experiencing the most development activity include Downtown San Jose, Santa Clara, Sunnyvale, and Mountain View.

Want to get a deeper look into the South Bay Multifamily Market? Download the full Market Report here.

View Our Multifamily Properties Here.

Office

In a pandemic era characterized by flexible, hybrid, and in some cases permanent remote-based work, San Jose’s office market has held up better than neighboring San Francisco, and the most coveted suburban submarkets popular with the world’s largest tech companies remain exceptionally tight. The robust performance can be credited partly to the dispersed geography of the market, with office space located in multiple employment centers throughout Silicon Valley, rather than being concentrated in a downtown central business district that relies on mass transit.

Leasing

Current vacancy in San Jose, at 12.6%, remains above the pre-pandemic vacancy rate of 9%. Positive net absorption over the past 12 months of 1.8 million SF indicates there is continued solid demand for office space. Looking forward, vacancy is expected to remain elevated for at least the near to midterm, reflecting the further delivery of new space and cost reduction initiatives of tech companies.

Construction

San Jose is one of the more active markets in the nation for office development with 7.4 million SF of office space under construction. A number of large self-build and preleased projects were delivered in recent months, as well as speculative projects successfully leased. As a result, continued development has been encouraged.

Want to get a deeper look into the South Bay Office Market? Download the full Market Report here.

View Our Office Properties Here.

Industrial

San Jose’s industrial market is driven by the growth of Silicon Valley’s technology-based economy. The impressive growth of this sector over the past 30 years has supported increased demand for specific types of industrial real estate, such as data centers and flex properties catering to high-tech firms conducting research and development and to some extent manufacturing.

Leasing

The San Jose industrial market has seen positive absorption in both the flex and logistic subtypes. Vacancy, at 6.0%, remains low in comparison to historical levels. This is primarily due to low levels of new construction and the continuation of the long-term trend to re-purpose older industrial sites for housing and other uses, which results in a net reduction in industrial stock.

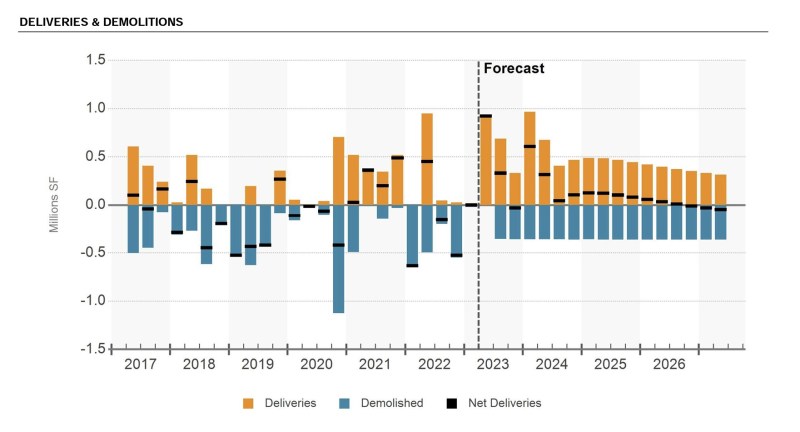

Construction

Robust demand for logistics and flex properties has increased the attractiveness of these property types, driving construction activity up with 3.2 million SF underway. Most of the space currently under construction is preleased data center space. Logistics space under construction amounts to just 390,000 SF, which suggests that the very low vacancy rate for distribution properties is set to continue.

Want to get a deeper look into the South Bay Industrial Market? Download the full Market Report here.

View Our Industrial Properties Here.

Retail

In San Jose, the investment market has been active in the past two years, with a historically high volume of deals in 2022, led by sales of power centers and neighborhood center properties. However, transaction volume slowed sharply in the second half of 2022, with investor interest dampened by interest rate hikes and economic uncertainty.

Leasing

After starting the year strongly, leasing activity slowed during the second half of 2022. High inflation and interest rates dampened consumer confidence and prompted a more cautious approach by retailers. Over the past 12 months, the market saw net absorption of just 310,000 SF. Mall properties were the best performers on this measure, with the vacancy rate declining from 5.2% to 3.5% over the past 12 months.

Construction

The amount of retail space under construction, currently at 200,000 SF, is below the long-term average in this market. The main product types under construction are either stand-alone sites for car dealerships or street-level retail that are part of a larger residential development.

Want to get a deeper look into the South Bay Retail Market? Download the full Market Report here.

View Our Retail Properties Here.

*Source: CoStar