Multifamily

Heading into the final quarter of 2023, demand in San Jose’s multifamily market is still robust, with above-average levels of absorption and low vacancy. Concerns from earlier in the year, that high interest rates and economic uncertainty in the face of tech layoffs and bank failures would diminish leasing activity, appear to have been unfounded. However, rent growth has slowed, as landlords focus on tenant retention over rent increases.

Vacancy

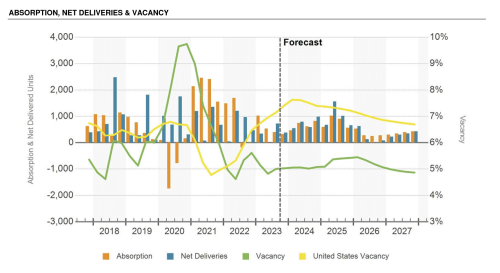

While somewhat lower than the exceptional highs of 2021, absorption has been robust in 2023, For the past 12 months, net absorption was 2,000 units, which is broadly in line with the demand levels in the pre-pandemic decade. And with deliveries slipping to 1,400 units in the past year, the lowest count since 2017, the vacancy rate has reduced to 5.0%, which is a little lower than the metro area’s long-term average, while outperforming the national average, which currently stands at 7.2%.

Construction

As of the fourth quarter, about 8,000 units are under construction, representing 5.1% of the market’s inventory. This is close to the all-time high level of construction activity and compares to the 10-year average of 7,100 units actively under construction across the metro. However, this rate of development is by no means unsustainable, being generally consistent with the average rate across the nation.

Want to get a deeper look into the South Bay Multifamily Market? Download the full Market Report here.

View Our Multifamily Properties Here.

Office

Investment sales activity has slowed in the past year to about half its long-term average. However, overall pricing has stayed robust, with some properties trading above $1,000/SF while others sell at much lower levels. Weakening demand is impacting rents, with average rent levels moving downward over the past year. Rent growth is forecast to remain negative for the next several years.

Leasing

An uptick in companies exiting leases or putting space on the sublet market has seen vacancy and availability rise over the past year. As of the fourth quarter, vacancy is 15.1% and the availability rate is 19.4%. Vacancy is projected to rise above 16% by the end of 2023 as new speculative space is delivered to the market. Sublease space availability currently stands at 8.2 million SF, an all-time high. Year-to-date leasing volume is comparable to the low points of both the Pandemic and the Great Recession. Notably, the number of new leases is only slightly below the longer-term average. Instead, it is the average lease size that has fallen. This pattern matches the national secular trend of companies downsizing to smaller spaces in response to their employees spending fewer days in the office.

Construction

San Jose is one of the more active markets in the nation for office development. As of the fourth quarter, 5.4 million SF of office space is under construction, representing 3.8% of the market’s existing inventory, well above the national average of 1.3%. While speculative office projects have been quick to lease in the past, weakening demand from tech tenants in 2023 is presenting leasing challenges, particularly in Downtown San Jose, where much of the new product is set to deliver.

Want to get a deeper look into the South Bay Office Market? Download the full Market Report here.

View Our Office Properties Here.

Industrial

As 2024 approaches, San Jose industrial leasing continues to be negatively impacted by subdued demand, as tenants hold back on expansion plans in the face of high interest rates. In the tightly held areas of central Silicon Valley, investors continue to pick up assets leased to highly creditworthy tenants, with no notable reduction from price levels seen in recent years. For example, in August, BGO acquired a 75,000-SF flex building at 825 Stewart Dr. in Sunnyvale for $41 million, or $544/SF. The tenant, Apple, has made substantial investments in fitting out the property’s specialized lab space.

Leasing

After two years of demand growth, the San Jose Market has seen negative net absorption in 2023. Historically, San Jose has seen a steady reduction in the amount of leased space due to the effects of deindustrialization, characterized by the redevelopment of industrial sites for other uses, such as office or residential. However, the negative absorption in the past year is more cyclical in nature, reflecting muted tenant demand. While vacancy, at 6.6%, is up by around 50 basis points over the past year, it remains low in comparison to historical levels. San Jose’s flex inventory operates at a significantly higher vacancy rate (9.6% as of the third quarter) than properties in its logistics market, which is severely supply-constrained and currently has an aggregate vacancy rate of 3.6%.

Construction

Construction of new industrial buildings has increased to a 20-year high in San Jose. As of the fourth quarter, around 4.8 million SF of new construction is underway, which is the highest level of the past 10 years and compares to the 10-year average of 1.5 million SF. Strong demand and rent growth have prompted developers to break ground on new projects over the past three years. As a result, around 3 million SF of new space is expected to deliver over the next 12 months.

Want to get a deeper look into the South Bay Industrial Market? Download the full Market Report here.

View Our Industrial Properties Here.

Retail

In San Jose, as of the fourth quarter, there has been very little expansion in brick-and-mortar retail, with total retail inventory no higher than its 2019 level. Fortunately for owners, the low level of new construction has allowed vacancy to remain relatively low, and net absorption has been positive over the past 12 months, led by grocery stores, auto, and fitness-related uses. Transaction volume slowed sharply in the past year as investor interest was dampened by interest rate hikes and economic uncertainty. However, smaller deals are continuing to close in 2023, with buyer interest from local private investors and developers.

Leasing

The vacancy rate as of October 2023 is at 4.3%. Leasing deals that have closed in 2023 are primarily independent retailers, many of which are in categories such as beauty and personal care, fitness, fast food, and restaurants. San Jose has five super regional malls that dominate the market in terms of operational performance. These have been the most successful at keeping occupancy high, with the mall vacancy rate declining from 6% to 3.4% over the past 12 months.

Construction

As of the fourth quarter of 2023, the amount of retail space under construction in the market is 310,000 SF, which is below the five-year annual average of 410,000 SF. Construction is largely focused on infill developments, such as stand-alone sites for car dealerships or street-level retail as part of larger residential developments. Over half of the current space under construction is related to a Costco that is being developed in West San Jose.

Want to get a deeper look into the South Bay Retail Market? Download the full Market Report here.

View Our Retail Properties Here.

*Source: CoStar