Multifamily

Heading into the final quarter of 2023, the San Francisco multifamily market is showing signs of stability after the volatility of recent years. Net absorption and deliveries are both modest in comparison to historic trends. The vacancy rate is falling but remains above pre-pandemic levels. Rent growth is flat and, unlike most other markets, average rents in San Francisco are still lower than the peak levels achieved in 2019. Construction activity has shifted from the city of San Francisco to the Peninsula. Investment activity is muted, reflecting broader economic headwinds.

Vacancy

As of the fourth quarter of 2023, the apartment vacancy rate in San Francisco stands at 6.6%, a reduction of around 60 basis points since this time last year. With low levels of new construction and improving demand, the market’s vacancy rate is moving slowly back toward its pre-pandemic average of 5% to 6%. Unlike much of the nation, where vacancy has increased in the past year because of both record levels of new construction and escalating rents, San Francisco has maintained its steady recovery, with a 12-month net absorption of 1,800 units, right in line with the 10-year average.

Construction

The volume of new apartment completions in San Francisco has slowed. As of the fourth quarter, just 1,100 units delivered over the past year. This compares to the 5-year average of 2,200 units per year. However, the pace of new construction has picked up recently, and approximately 2,000 units are projected to be completed in calendar year 2024. Almost all of the stock of market-rate units under construction is in 4 & 5 Star buildings. In total, there are 3,900 units underway. The under-construction stock measures 2.2% of existing inventory, well below the average rate of 5.1% across the nation.

Want to get a deeper look into the San Francisco Bay Multifamily Market? Download the full Market Report here.

View Our Multifamily Properties Here.

Office

Heading towards the end of 2023, the cumulative impact of three years of weakening operating performance and 18 months of elevated interest rates is taking a heavy toll on San Francisco office valuations. Owners, particularly those that financed their properties with debt during the past ten years, are seeing substantial reductions in equity value, leading several to default on mortgage loans. Local all-cash buyers are stepping in to acquire properties at deeply discounted prices.

Leasing

The overall vacancy rate for the San Francisco Market increased to 21.0% in the fourth quarter and is forecast to rise further, having now passed the previous high point of 16% that occurred during the dotcom bust in 2002. Annual net absorption was negative by -9.2 million and, with 12.7 million SF of sublease space available, the availability rate has increased to 26.1%. Two-thirds of available sublet space is vacant, indicating that many tenants have already vacated spaces that will not be renewed. By comparison, the national availability rate currently stands at 16.7%.

Construction

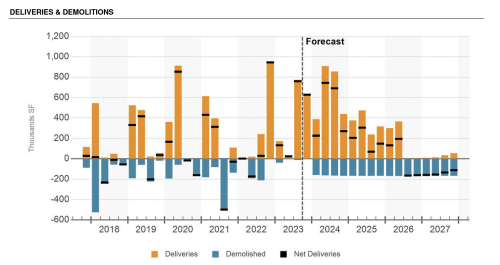

Office construction activity in San Francisco remains subdued, with developers reluctant to commence projects while demand for existing spaces remains weak. About 830,000 SF of net new office space completed during the past 12 months. Major completions include two buildings comprising 421,000 SF in Kilroy’s Oyster Point development, both of which were preleased by Stripe, a payment processing platform. In San Francisco, Visa’s new headquarters, a 300,000 SF building at Mission Rock, was recently completed.

Want to get a deeper look into the San Francisco Bay Office Market? Download the full Market Report here.

View Our Office Properties Here.

Industrial

In the fourth quarter of 2023, the San Francisco industrial market continues to see rising vacancy and moderating rent growth, as an influx of new flex space encounters slowing demand. The investment market is showing signs of a sharp slowdown after two years of elevated activity. High interest rates and investor caution have dampened demand and resulted in total sales volume of just $467 million in the past 12 months. By comparison, annual sales volume peaked at $1.6 billion in early 2022.

Leasing

The slowdown in leasing activity that began a year ago is still shaping activity heading towards 2024. Total industrial leasing volume in 2023 is looking like it will finish at the lowest amount since the Great Recession. Flex vacancy increased by 7.8% in the past year and stands at 17.7% in the fourth quarter. By comparison, logistics space vacancy remains close to its long-term average at 5.0%. Overall market vacancy ticked up to its current rate of 9.0%.

Construction

San Francisco’s industrial market is seeing a historically high level of development, with around 1 million SF delivered in 2023 and 5 million SF of space currently under construction. These projects are all flex buildings that are predominantly aimed at providing R&D space for the life science/biotech industry. This sector has seen high levels of growth and occupier demand in recent years, but as of the fourth quarter of 2023, tenant expansion activity has slowed sharply on the back of high-interest rates and recessionary challenges.

Want to get a deeper look into the San Francisco Bay Industrial Market? Download the full Market Report here.

View Our Industrial Properties Here.

Retail

In the investment market, transaction activity remains low amid the persistence of high-interest rates and concerns about the viability of some San Francisco locations. Financial distress related to imminent loan maturities is also a growing concern. In downtown San Francisco, both the Westfield Center and the building formerly occupied by the Saks Fifth Avenue Men’s Store have been transferred to lender ownership this year. Several other retail properties have loan maturities within the next two years, with the largest being Stonestown Galleria, where a $165.5 million loan is scheduled to mature in October 2023.

Leasing

Retail vacancy in San Francisco was one of the lowest in the nation in 2019, but is now one of the nation’s highest, at 5.9%. Designer boutiques have maintained, and in some cases expanded, their presence in recent years, despite the drop in foreign tourism, which provides a large share of their income. San Francisco’s smaller retail centers and urban main street shopping districts have generally performed well in recent years, benefitting from the shift in working patterns that has led to people spending more time shopping closer to home in their local neighborhoods.

Construction

As of the fourth quarter, construction activity in San Francisco is at a historically low level. The construction pipeline consists of a small number of mixed-use redevelopment projects and a single Safeway store, with a total volume of 220,000 SF underway. This compares to the five-year average of 500,000 SF. The combination of a lack of developable sites and restrictive planning policies has limited the volume of new retail development. Historically, this has kept rents high and vacancies relatively low. However, population decline over the past several years has reduced demand and increased vacancies, thus reducing developer interest in new retail projects. Moreover, the current period of high-interest rates has raised the cost of construction financing, thereby presenting an additional challenge to the feasibility of retail developments.

Want to get a deeper look into the San Francisco Bay Retail Market? Download the full Market Report here.

View Our Retail Properties Here.

*Source: CoStar