Multifamily

Recovery in San Francisco has been slower than the national market, which improved rapidly in 2021. The city has the lowest return to office metrics in the nation. Consequently, apartment vacancy has recovered only to 7.4%, and rents are still below 2019 levels. However, the average rent in San Francisco is still the highest in the nation. The trailing 12-month absorption for market-rate apartments sits at 1,200 units, compared to a low point of -6,300 units at the height of the pandemic. In the investment market, sales activity has slowed substantially over the past year, as the effects of interest rate increases and economic uncertainty dampened investor interest.

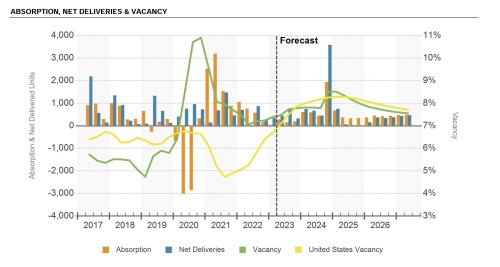

Vacancy

The vacancy rate in San Francisco currently stands at 7.4%. In alignment with national trends, demand and absorption slowed in the second half of 2022, as the impact of high inflation and rising interest rates dampened renter activity and new household formation. This has continued in 2023. However, because the construction pipeline was muted, San Francisco did not see the sharper uptick in the vacancy rate that was recorded in many other US markets. Annual net absorption, at 1,200 units, is in line with the metro’s long-term average.

Construction

Almost all of the stock of market-rate units under construction is in 4 & 5 Star buildings. In total, there are 7,800 units underway; however, that total includes 3,500 units in the massive Treasure Island redevelopment project, which will create a new neighborhood of around 8,000 homes. Although recent development has been robust in comparison to historical standards, San Francisco is generally more insulated from supply risk than most markets in the country.

Want to get a deeper look into the San Francisco Bay Multifamily Market? Download the full Market Report here.

View Our Multifamily Properties Here.

Office

After several years of very strong growth in rents and other costs of doing business, several major employers were either planning or enacting relocations to less-expensive markets. San Francisco stalwarts, such as McKesson and Charles Schwab, moved their headquarters and most of their staff to Texas, while PG&E relocated to Oakland. Downtown availability, at 28%, suggests that as leases roll over, businesses are planning to downsize and consolidate their space. Sublease space remains at record highs, and new leasing activity is depressed, with most deals being either renewals or subleases. Rents have fallen across all submarkets, but most notably in downtown San Francisco, where Class A sublease space is advertised for as low as $35/SF.

Leasing

The overall vacancy rate increased to 18.4% in 23Q1 and is forecast to rise further, having now passed the previous high point of 16% that occurred during the dotcom bust in 2002. With negative net absorption for the past 12 months of-6.4 million SF, much of that newly available space will likely become vacant as leases roll over. The dominance of tech companies in San Francisco is one of the main causes of weak demand. Starting in 2020, many of the major tech firms headquartered in San Francisco offered some portion of their offices for sublet. This continued in 2022, with major sublease additions from Autodesk, Slack, Salesforce, Airbnb, and Lyft, among others.

Construction

New construction, while almost non-existent in downtown San Francisco, is underway in South San Francisco and the Peninsula. Over 2.5 million SF is under construction, primarily in the life science sector, which continues to perform well. Continuing demand for biotechnology space is the driver behind the largest campus project to begin construction in 2022. The Elco Yards project in Redwood City is a mixed-use development that includes approximately 500,000 SF of life sciences office space in four individual buildings. Several approved developments have been delayed due to canceled commitments and unforeseen economic challenges stemming from the pandemic.

Want to get a deeper look into the San Francisco Bay Office Market? Download the full Market Report here.

View Our Office Properties Here.

Industrial

In the second quarter of 2023, the San Francisco industrial Market is characterized by a rapidly growing supply of flex space and a tight and shrinking supply of logistics space. In recent years the booming life sciences sector led to a surge in demand by biotech companies for R&D space. In contrast, the inventory of logistics and distribution space in San Francisco has been on a steady downward trend for many years, as old industrial sites were demolished or repositioned for other uses. The San Francisco Peninsula is mostly built out and land is expensive.

Leasing

The slowdown in leasing activity that began in the second half of 2022 has continued into 2023. Outside of the pandemic slowdown in 2020, total industrial leasing volume in both 22Q4 and 23Q1 was the lowest since the great recession. The leasing slowdown has come about as higher interest rates and economic uncertainty reduced demand for industrial space. Moreover, the demand from biotech companies for R&D space has diminished as venture capital funding has dried up. Coming at a time that coincides with a spike in the delivery of newly constructed flex R&D space, the result has been an increase in vacancy. Overall market vacancy ticked up to its current rate of 7.1%.

Construction

San Francisco’s industrial market is seeing a historically high level of development, with over 4 million SF of space currently under construction. In South San Francisco, new buildings have been completed in the past year for Genentech, InterVenn, and Cytokinetics. In addition to these new construction projects, there are a handful of conversion projects, typically involving older office, retail, or industrial buildings being redeveloped as flex space.

Want to get a deeper look into the San Francisco Bay Industrial Market? Download the full Market Report here.

View Our Industrial Properties Here.

Retail

As of the second quarter of 2023, San Francisco’s retail market is lagging the performance of most other metros across the nation. The retail vacancy rate, which was one of the lowest in the nation in 2019, increased in the post-pandemic period, is now one of the nation’s highest, at 5.6%. Similarly, average market rent, which increased at an annual rate of 3.4% nationally over the past 12 months, saw an increase of just 0.3% in San Francisco. Nevertheless, rents remain stubbornly high: San Francisco still has the second-highest rent levels in the nation, after New York.

Leasing

Union Square’s historic position as the preeminent retail center in Northern California has deteriorated in recent years, with the closure of many important retailers, including department stores, designer boutiques, and mainstream chain stores. The announcement in May 2023 that Nordstrom was shuttering both its department store and its Nordstrom Rack store in downtown San Francisco was the latest in a series of blows to market. In the San Bruno/Millbrae Submarket, one of San Francisco’s oldest malls, is to be redeveloped for nonretail uses.

Construction

There is currently a total volume of 92,000 SF underway. Renovation of existing properties is the most common source of new-to-market retail space. Redevelopment of brownfield sites is an additional source of new retail space; however, these projects tend to focus on other uses, such as apartments and office, with a smaller component of ancillary retail. For example, the Gateway at Millbrae Station is a large mixed-use project that includes residences, affordable housing, offices, and a hotel, together with 44,000 SF of street-level retail.

Want to get a deeper look into the San Francisco Bay Retail Market? Download the full Market Report here.

View Our Retail Properties Here.

*Source: CoStar